Are you losing thousands of rupees in hidden fees when receiving payments from international clients? As India’s freelance economy grows toward a projected $100 billion by 2027, understanding how to efficiently receive foreign payments has become crucial for success1. Whether you’re a freelancer in Bangalore serving US clients, a SaaS startup in Pune with European customers, or an agency in Mumbai working with Australian partners, this comprehensive guide will help you save up to ₹31,000 per transaction while staying fully compliant with RBI regulations.

- Why This Guide Matters: The ₹15,000 Problem

- Current Exchange Rate Landscape

- Platform-by-Platform Analysis: The Complete Fee Breakdown

- Platform Comparison: See the Real Cost Impact

- Currency-Specific Receiving Strategies

- Legal and Tax Compliance: Stay on the Right Side of RBI

- Documentation Best Practices

- Advanced Optimization Strategies: Professional Hacks

- The ₹1 Lakh Annual Savings Calculator

- Geographic-Specific Considerations

- Red Flags and Common Mistakes to Avoid

- Future-Proofing Your Payment Strategy

- Action Plan: Implement Your Optimized Payment Strategy

- Conclusion: Your Path to International Payment Mastery

Why This Guide Matters: The ₹15,000 Problem

Every month, Indian professionals collectively lose millions of rupees to inefficient payment methods. A recent analysis shows that on a typical $9,000 invoice:

- Traditional methods: Keep only ₹746,323 (17% loss to fees)

- Optimized platforms: Receive ₹774,464 (3.4% loss to fees)

- Potential savings: Over ₹28,000 per transaction

This guide reveals exactly how to capture those savings while maintaining full legal compliance.

Current Exchange Rate Landscape

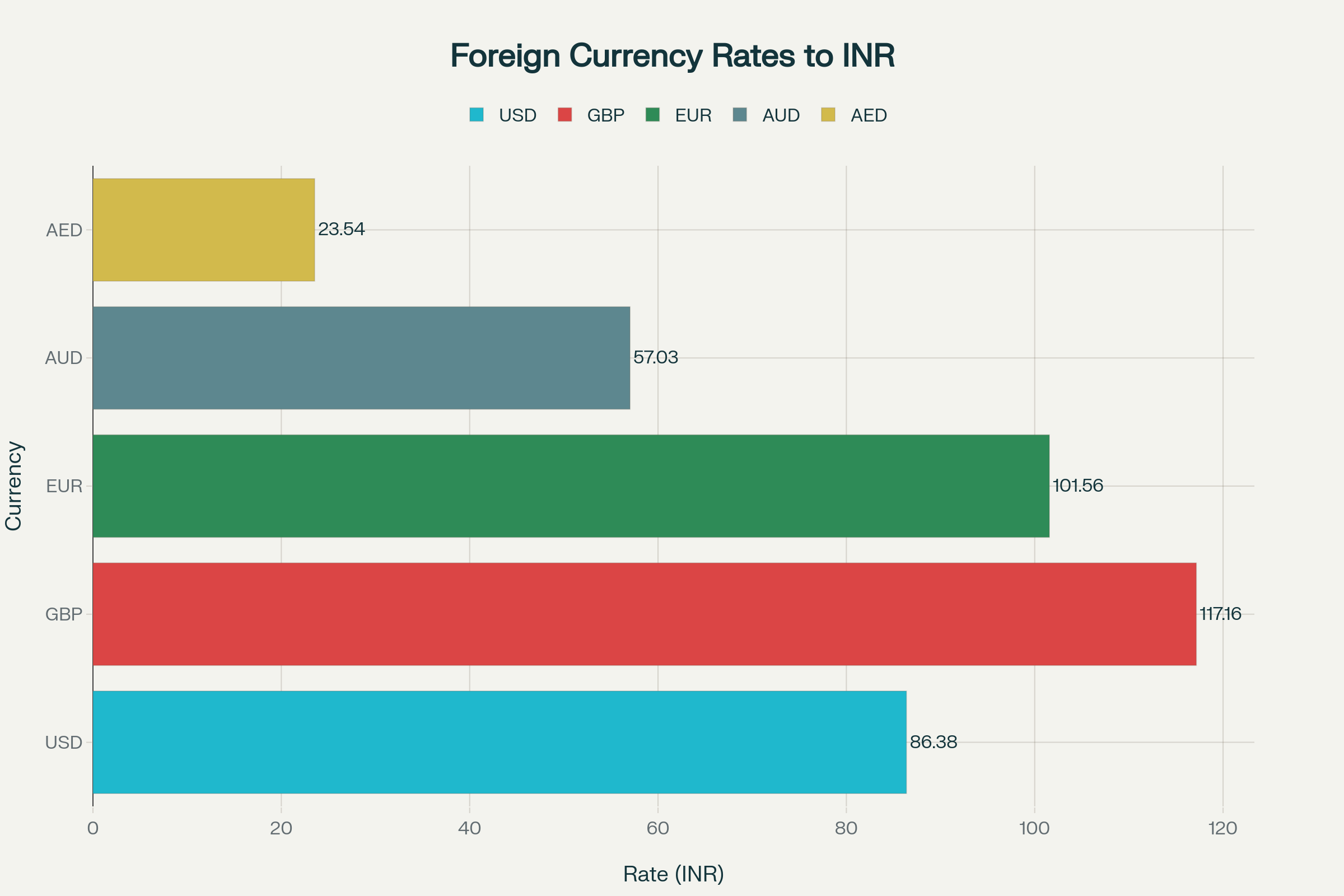

current exchange rates is fundamental to maximizing your foreign payment value. Here are the mid-market rates as of July 2024:

Current exchange rates for major foreign currencies to Indian Rupee

Key Currency Insights:

- GBP offers the highest value per unit at ₹117.16, making UK clients particularly lucrative

- EUR provides strong returns at ₹101.56, ideal for European markets

- USD remains the global standard at ₹86.38, with the largest volume of opportunities

- AUD at ₹57.03 serves the growing Australian market

- AED at ₹23.54 caters to the booming Middle East economy

Platform-by-Platform Analysis: The Complete Fee Breakdown

1. Skydo – The Cost Leader for Mid-Range Invoices

Optimal For: Invoices between $2,000-$10,000

Fee Structure:

- Up to $2,000: $19 + 18% GST

- $2,001-$10,000: $29 + 18% GST

- Above $10,000: 0.3% + 18% GST

Key Advantages:

- Zero forex markup: True mid-market rates

- Instant FIRA: Download immediately after payment

- 24-hour settlement: Fastest INR credit in the market

- RBI PA-CB licensed: Full regulatory compliance

- India-based support: Local customer service team

Best For: Regular business payments, export invoices, consistent international income streams23.

2. Briskpe – The Percentage Winner for Smaller Amounts

Optimal For: Invoices under $2,600

Fee Structure:

- 0.75% + 18% GST (₹500 minimum from July 2025)

- Zero forex markup

Key Advantages:

- Beats Skydo on amounts under $2,600 due to percentage-based fees

- 24-48 hour settlement: Quick turnaround

- Multi-currency virtual accounts: Global receiving capabilities

- E-FIRA included: Free compliance documentation

Best For: Frequent small payments, retainer-based work, micro-consulting projects3.

3. Mulya – The Hold-and-Convert Specialist

Optimal For: Freelancers wanting timing flexibility

Fee Structure:

- 1% flat fee (no GST)

- Zero forex markup

Key Advantages:

- 9-month USD holding: Time your INR conversion optimally

- FIRS within 24 hours: Quick compliance documentation

- JPMorgan Chase partnership: Secure USD virtual accounts

- Simple withdrawal process: User-friendly interface

Best For: Seasonal work, clients who pay in advance, forex timing strategies3.

4. Wise – The Traditional Choice with Caveats

Optimal For: One-off large transfers, established businesses

Fee Structure:

- Bank deposits: 1.78% + $6.11 wire + $2.50 e-FIRC

- UPI transfers: Same fees but ₹200,000 limit per transfer

Key Advantages:

- Global recognition: Widely accepted platform

- Mid-market rates: No hidden forex markup

- Fast settlements: 90% under 24 hours

Limitations:

- UPI splitting required: Large invoices need multiple transfers

- Expensive for business use: High percentage-based fees

- Fee multiplication: Each UPI split incurs full fixed costs3.

5. Payoneer – The Marketplace Integration Leader

Optimal For: Marketplace sellers, platform-based freelancers

Fee Structure:

- Bank transfers: Free receiving, but 3% currency conversion

- Credit card payments: 3.2% + $0.49 per transaction

- USD virtual accounts: 1% receiving fee

- Annual fee: $29.95 if under $2,000 received annually

Key Advantages:

- Marketplace integrations: Direct connectivity with Fiverr, Upwork, Amazon

- Global virtual accounts: Receive like a local in 70+ currencies

- Invoice creation tools: Built-in billing system

- Client payment flexibility: Multiple payment methods

Major Drawback: Highest total costs among all platforms, with effective rates reaching 4-6% for typical business use245.

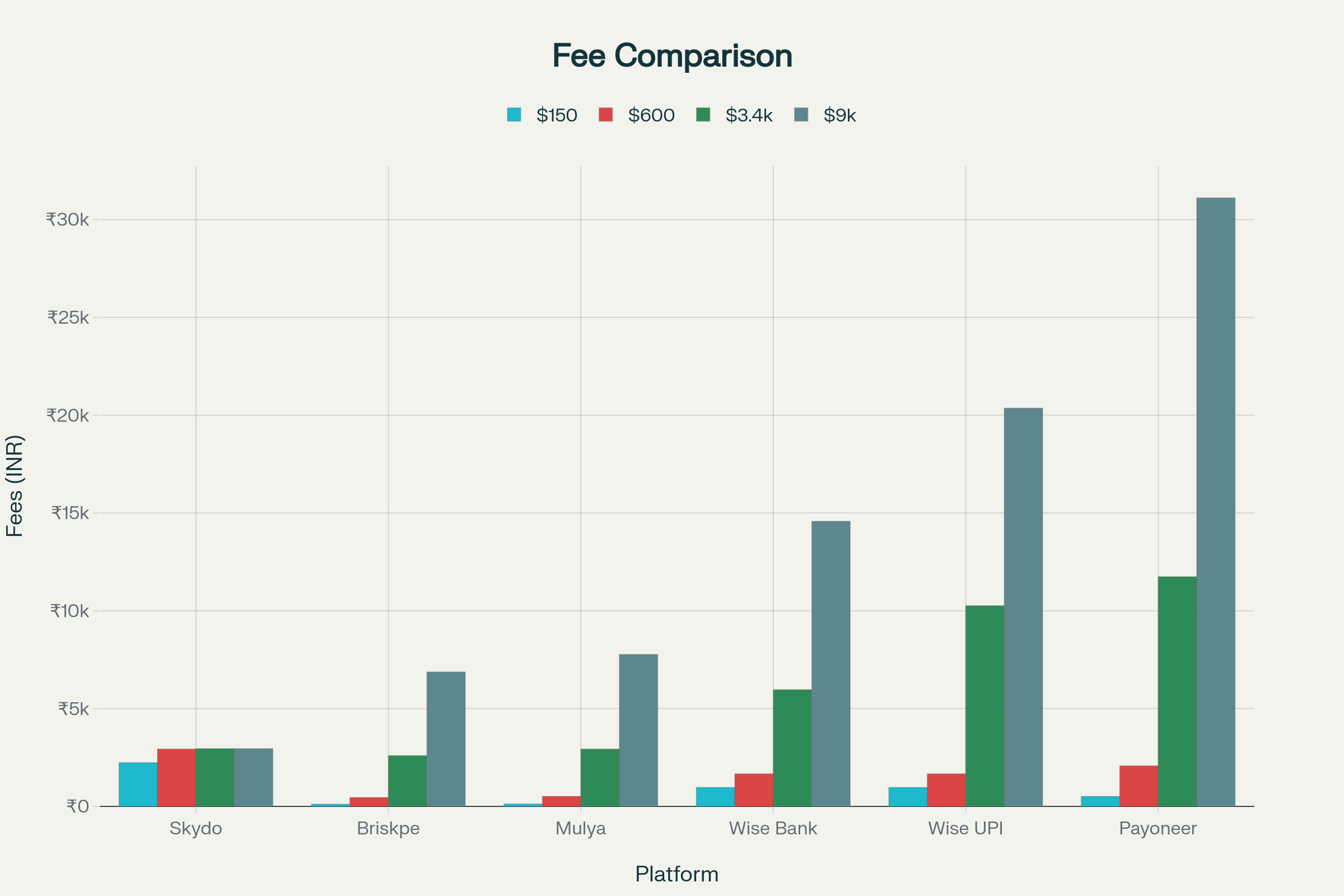

Platform Comparison: See the Real Cost Impact

Payment platform fee comparison for receiving foreign payments in India

The data reveals dramatic differences in total costs across platforms and invoice sizes. For a $9,000 invoice:

| Platform | Total Fee (INR) | Net Received (INR) | Loss vs. Best Option |

|---|---|---|---|

| Skydo | ₹2,956 | ₹774,464 | Best Choice |

| Briskpe | ₹6,880 | ₹770,540 | ₹3,924 less |

| Mulya | ₹7,774 | ₹769,646 | ₹4,818 less |

| Wise Bank | ₹14,582 | ₹762,838 | ₹11,626 less |

| Wise UPI | ₹20,365 | ₹757,055 | ₹17,409 less |

| Payoneer | ₹31,117 | ₹746,323 | ₹28,141 less |

Currency-Specific Receiving Strategies

USD (United States) – 86.38 INR

- Volume: Highest opportunity volume globally

- Best platforms: Skydo for regular business, Wise for one-off large amounts

- Client preferences: ACH transfers, wire transfers, business checks

- Optimization tip: Bundle smaller invoices to reach Skydo’s $2,001+ tier

GBP (United Kingdom) – 117.16 INR

- Volume: High-value creative and consulting work

- Best platforms: All platforms support GBP well; choose based on amount

- Client preferences: Faster payments, international transfers

- Optimization tip: UK clients often pay quickly, perfect for early payment discounts

EUR (European Union) – 101.56 INR

- Volume: Growing tech and design market

- Best platforms: SEPA-enabled platforms for EU bank transfers

- Client preferences: SEPA transfers, international wires

- Optimization tip: SEPA transfers often free for EU clients, factor this into pricing

AUD (Australia) – 57.03 INR

- Volume: Emerging market with high payment reliability

- Best platforms: Wise and Payoneer have strong AUD support

- Client preferences: PayID, bank transfers, business payments

- Optimization tip: Australian business hours align well with Indian evening work

AED (UAE/Dubai) – 23.54 INR

- Volume: Rapidly growing Middle East market

- Best platforms: Regional platforms often better for AED

- Client preferences: Bank transfers, Islamic finance-compliant methods

- Optimization tip: UAE businesses often require formal invoicing and FIRC documentation

Legal and Tax Compliance: Stay on the Right Side of RBI

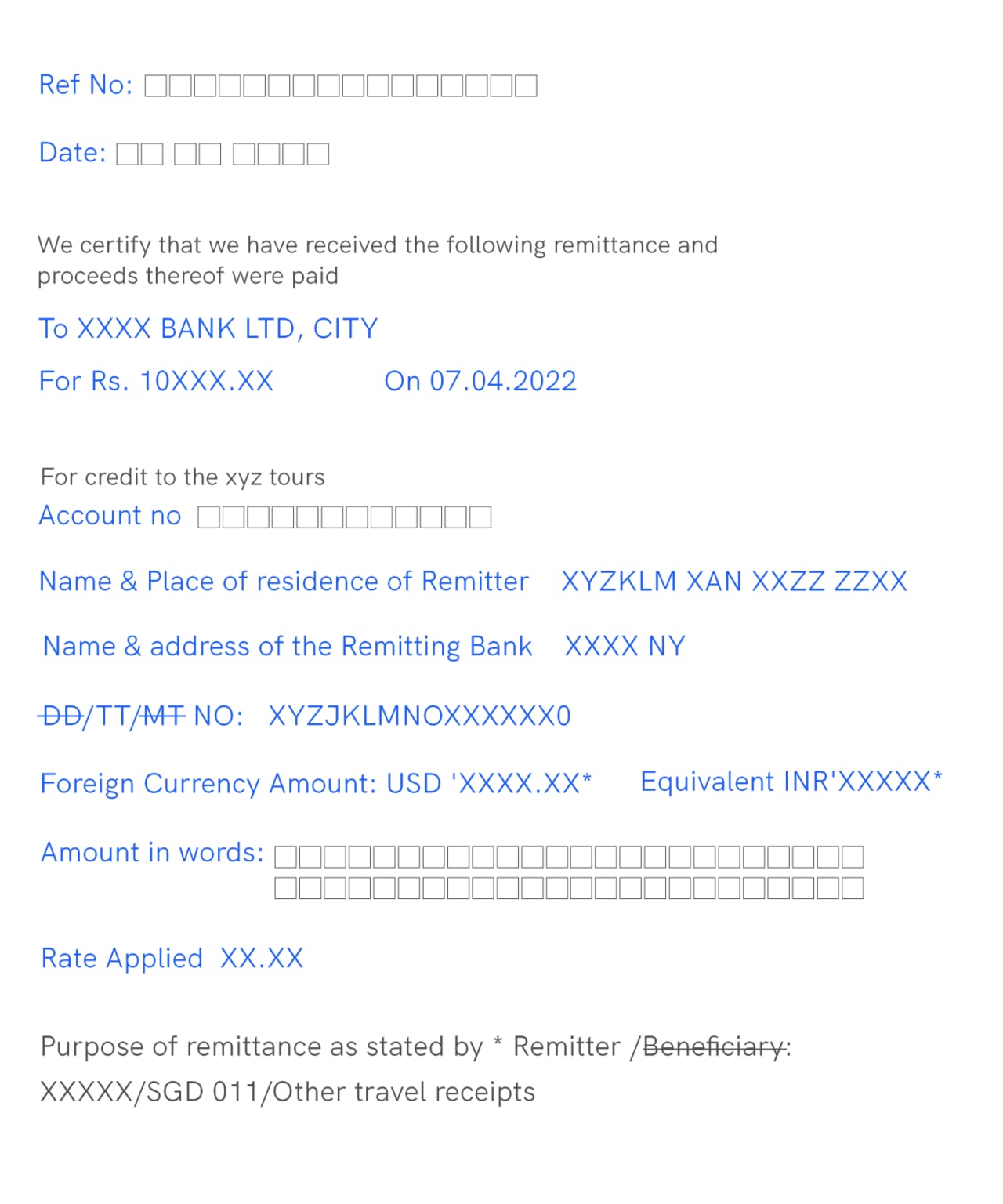

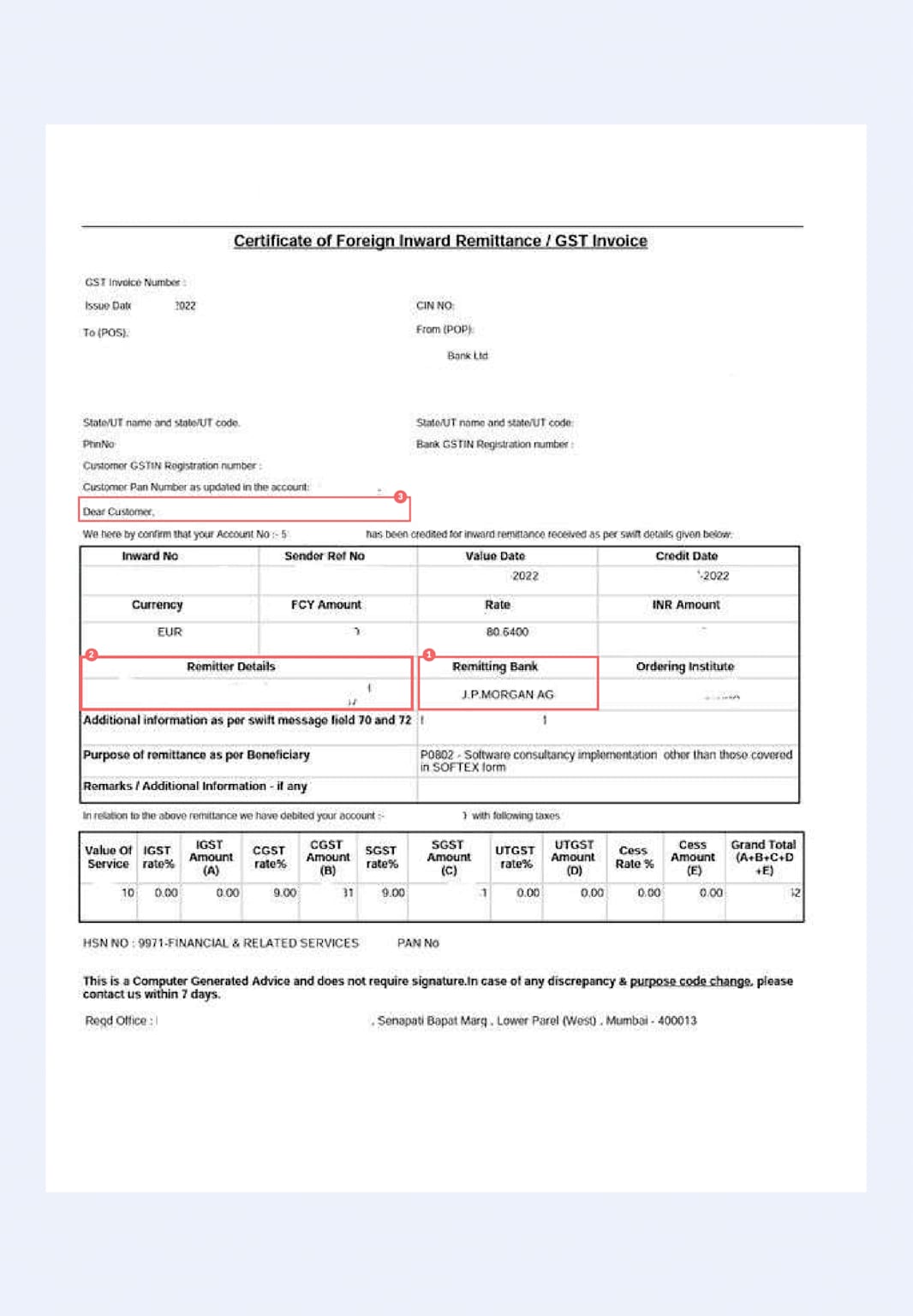

Sample Foreign Inward Remittance Certificate (FIRC) format showing remittance details for foreign funds credited to an Indian bank account salt

RBI Compliance Requirements

1. FIRA/FIRC Documentation

Every foreign payment requires proper documentation:

- FIRA (Foreign Inward Remittance Advice): Digital proof of payment receipt

- FIRC (Foreign Inward Remittance Certificate): Formal certificate for larger amounts

- Purpose codes: Correctly classify your service type (P0802 for software, P0803 for consulting)

2. Export Documentation

For service exports above certain thresholds:

- LUT (Letter of Undertaking): Export without paying GST upfront

- GST registration: Mandatory for exports over ₹20 lakh annually

- EDPMS reporting: Banks must report to RBI’s Export Data Processing System

Tax Implications and Optimization

Income Tax Considerations:

- Resident taxation: All global income taxable in India

- Presumptive taxation: 50% of receipts under Section 44ADA (up to ₹50 lakh annually)

- Advance tax: Quarterly payments required if liability exceeds ₹10,000

- DTAA benefits: Claim foreign tax credits to avoid double taxation

GST Framework:

- Zero-rated exports: No GST on services to foreign clients

- ITC claims: Claim GST paid on business inputs

- Compliance: Regular returns required for registered businesses

Sample certificate of foreign inward remittance showing remitting bank, currency, GST details, and inward credit information relevant for receiving foreign funds into an Indian bank account skydo

Documentation Best Practices

Essential Records to Maintain:

- Client contracts with clear payment terms

- Invoice copies with proper export formatting

- FIRA/FIRC certificates for all receipts

- Bank statements showing foreign credit

- Purpose code documentation for RBI compliance

- GST records if registered for exports

Advanced Optimization Strategies: Professional Hacks

Hack 1: The Currency Hedging Strategy

- Use Mulya’s 9-month holding to time INR conversion during favorable exchange rate periods

- Monitor seasonal patterns: USD typically strengthens in Q4, EUR in Q2

- Set rate alerts: Use platform tools to convert when rates improve by 2-3%

Hack 2: The Invoice Bundling Method

- Combine small payments to reach better fee tiers

- Example: Four $500 invoices = $2,000, moving from expensive small payment fees to Skydo’s $19 tier

- Client benefit: Reduced transaction overhead for them too

Hack 3: The Early Payment Incentive

- Offer 2-3% discount for payments within 10 days

- Improves cash flow while still saving vs. platform fees

- Client wins: They save money and you get faster payment

Hack 4: The Multi-Platform Strategy

- Skydo for regular business ($2,000-$10,000 range)

- Briskpe for small amounts (under $2,000)

- Wise for urgent one-offs (when speed matters most)

- Mulya for advance payments (when you can hold USD)

Hack 5: The Compliance Automation

- Digital invoice templates with export formats pre-built

- FIRA download automation immediately after payments

- GST filing preparation with proper export classification

- Client education on their payment options to choose cheapest

The ₹1 Lakh Annual Savings Calculator

Based on typical freelancer/business scenarios:

Scenario A: Regular Freelancer (₹30 lakh annual foreign income)

- Current method (PayPal): Total fees ₹1,50,000+ annually

- Optimized method (Skydo): Total fees ₹45,000 annually

- Annual savings: ₹1,05,000

Scenario B: Growing Agency (₹75 lakh annual foreign income)

- Current method (Payoneer): Total fees ₹3,75,000+ annually

- Optimized method (Mixed strategy): Total fees ₹1,12,500 annually

- Annual savings: ₹2,62,500

Scenario C: Enterprise Services (₹2 crore annual foreign income)

- Current method (Bank wires): Total fees ₹6,00,000+ annually

- Optimized method (Skydo + negotiated rates): Total fees ₹2,40,000 annually

- Annual savings: ₹3,60,000

Geographic-Specific Considerations

Working with US Clients

- ACH preferences: Offer US bank account details through platforms

- State tax implications: Some US clients need 1099 forms for Indian contractors

- Payment timing: Most US clients pay monthly or on NET-30 terms

- Best practices: Invoice early in their month for faster processing

Working with UK Clients

- Faster payments: UK clients can send same-day payments

- VAT considerations: UK clients don’t need to apply VAT on your services

- Banking preferences: Direct bank transfers very common

- Cultural note: UK clients often appreciate detailed invoices

Working with European Clients

- SEPA advantages: EU internal transfers often free for sender

- GDPR compliance: Ensure your payment data handling meets GDPR standards

- Currency preference: Some clients prefer EUR even from non-EUR countries

- Holiday considerations: August shutdowns common, plan cash flow accordingly

Working with Australian Clients

- PayID adoption: Australian equivalent of UPI, increasingly popular

- Time zone benefits: Australian business hours overlap with Indian mornings

- Compliance requirements: Some Australian companies require vendor registration

- Payment reliability: Australian businesses typically have excellent payment records

Working with UAE Clients

- Islamic finance compliance: Some UAE clients require Sharia-compliant payment methods

- Documentation requirements: UAE businesses often need formal contracts and certificates

- Banking relationships: Strong banking ties between UAE and India enable efficient transfers

- Growth opportunity: Rapidly expanding market with increasing Indian service demand

Red Flags and Common Mistakes to Avoid

Platform Selection Mistakes

❌ Using PayPal for business: 4.4% + forex markup = 6-8% total cost

❌ Splitting large Wise UPI payments: Multiplies fixed fees unnecessarily

❌ Ignoring GST registration: Missing ITC claims worth thousands

❌ Using Payoneer for regular business: Most expensive option for steady income

Compliance Failures

❌ Missing FIRA downloads: Creates audit trail gaps

❌ Wrong purpose codes: Can trigger RBI inquiries

❌ No LUT filing: Paying GST upfront unnecessarily

❌ Poor record keeping: Complicates tax filing and compliance

Client Relationship Errors

❌ Not educating clients: They choose expensive payment methods

❌ Fixed payment terms: Missing opportunities for discounts/optimization

❌ Single platform dependency: Creates unnecessary risk and cost

❌ Ignoring compliance: Puts both parties at regulatory risk

Future-Proofing Your Payment Strategy

Emerging Trends to Watch

- Central Bank Digital Currencies (CBDCs): Could revolutionize cross-border payments

- Blockchain settlements: Potentially reducing costs and settlement time

- AI-powered compliance: Automated purpose code assignment and documentation

- Enhanced UPI international: Expansion beyond current limits and countries

Regulatory Changes Coming

- Stricter FEMA compliance: Enhanced reporting requirements likely

- GST automation: Integration with payment platforms improving

- LRS modifications: Potential changes to the $250,000 annual limit

- Digital tax treaties: Streamlined international tax credit mechanisms

Action Plan: Implement Your Optimized Payment Strategy

Week 1: Assessment and Setup

- Calculate current costs: Analyze last 12 months of foreign payments

- Choose primary platform: Based on your typical invoice amounts

- Set up accounts: Complete KYC for 2-3 platforms

- Prepare documentation: Organize contracts, invoices, tax records

Week 2: Client Transition

- Educate existing clients: Share new payment instructions

- Update invoices: Include multiple payment options

- Test small transactions: Verify everything works correctly

- Document procedures: Create standard operating procedures

Week 3: Compliance Integration

- Download historical FIRAs: Ensure complete documentation

- Set up GST processes: If applicable for your volume

- Create monitoring systems: Track fees, rates, and compliance

- Plan tax optimization: Discuss with CA/tax advisor

Week 4: Optimization and Monitoring

- Implement advanced strategies: Bundling, timing, multi-platform use

- Set up alerts: Exchange rate and fee monitoring

- Create quarterly reviews: Assess performance and adjust strategy

- Plan for growth: Prepare for higher volumes and complexity

Conclusion: Your Path to International Payment Mastery

The difference between a basic and optimized international payment strategy can mean ₹2-3 lakh additional annual income for most Indian professionals. By understanding the real costs, compliance requirements, and optimization opportunities outlined in this guide, you’re equipped to:

- Save 40-60% on payment fees through smart platform selection

- Maintain full RBI compliance with proper documentation and procedures

- Optimize currency conversion timing for additional 2-3% savings

- Scale internationally with confidence in your payment infrastructure

Remember: The best payment strategy is one that balances cost efficiency, compliance, and convenience. Start with the platform recommendations based on your typical invoice amounts, ensure proper compliance documentation, and gradually implement the advanced optimization strategies as your international business grows.

The global marketplace awaits – now you have the tools to capture your full earning potential while staying on the right side of Indian regulations.

Ready to optimize your international payments? Start by calculating your current annual payment costs and comparing them against the optimized strategies in this guide. Your future self will thank you for every rupee saved and every compliance headache avoided.

This guide is for educational purposes. Always consult with qualified chartered accountants and legal advisors for your specific situation.